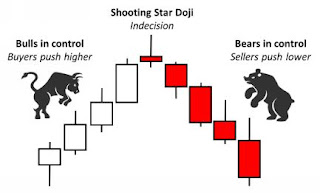

Dojis: Simple, Shooting Star, and Hammer

Dojis are another important candlestick pattern and come in different shapes and forms but are all characterized by having either no body or a very small body. A Doji is also an indecision candlestick that is similar to a spinning top. When you see a Doji on your chart, it means there is a strong fight occurring between the bears and the bulls. Nobody has won the fight yet.

Examples of Doji candlesticks.

In the picture above, a Doji tells us the same story as a spinning top does. In fact, most indecision (reversal) candles tell you basically the same thing. This will be discussed in greater detail in the next section.

At times Dojis have unequal top and bottom wicks. If the top wick is longer, it means that the buyers tried unsuccessfully to push the price higher. These types of Dojis, such as the shooting star, are still indecision candlesticks, but they may indicate that the buyers are losing power and that the sellers may take over.

If the bottom wick is longer, as in hammer Dojis, it means that the sellers were unsuccessful in trying to push the price lower. This may indicate an impending take over of price action by the bulls.

Bottom Reversal Strategy with an indecision hammer candlestick formed as sign of entry.

All Dojis indicate indecision and possible reversals if they form in a trend. If a Doji forms in a bullish trend, it suggests that the bulls have become exhausted and the bears are fighting back to take control of the price. Similarly, if a Doji forms in a bearish downward trend, it suggests that the bears have become exhausted and the bulls (buyers) are fighting back to take control of the price.

Top Reversal Strategy with an indecision Shooting Star candlestick formed as sign of entry.

After learning these candlesticks, it is important that you not get too excited too quickly. Candles are not perfect. If you take a trade every time you see a Doji formed in a trend, you will end up with significant losses. Always remember that these candles only indicate indecision and not a definite reversal. To use indecision candles effectively, you must look for confirmation candles and ideally use them with other forms of analysis such as support or resistance levels, both of which are explained in Chapter 7.